Are you prepared for the effect that mortgage stress can cause in the Australian real estate market? Whether you’re an experienced investor or an agent, it’s crucial to understand the intricate dance of factors at play within the property market, and mortgage stress is a significant part of that mix. This article pulls back the curtain on mortgage stress, revealing its hidden impacts on property values, shining a spotlight on the most affected suburbs, and underlining the vital importance of examining mortgage stress at the local-level.

What is Mortgage Stress?

Mortgage stress is a financial situation where homeowners spend 30% or more of their pre-tax income on mortgage repayments. According to the Australian Bureau of Statistics, when housing costs exceed this threshold, households may struggle to afford other essential living costs. While the specific percentage can vary, this 30% figure is a commonly accepted benchmark. This stress can lead to financial hardship, and in severe cases, may result in the inability to meet mortgage payments, leading to foreclosure.

What Impact Does Mortgage Stress Have on Property Values?

Mortgage stress can have significant repercussions on property values and the broader real estate market. When a large number of homeowners experience mortgage stress, it increases the supply of properties on the market, as distressed homeowners may be forced to sell. This oversupply can lead to a decrease in property values.

For instance, the Global Financial Crisis in 2008 witnessed a surge in mortgage stress levels, causing a temporary dip in Australian property prices. The negative effect of mortgage stress on property values can create opportunities for savvy investors to snap up undervalued properties. However, it also introduces more uncertainty into the market, making careful risk assessment crucial.

Why is it Important to Look at Mortgage Stress on a LGA-Level?

Examining mortgage stress on an LGA-level provides granular insight into the local housing market conditions. Each LGA has unique economic factors, housing supply and demand, employment rates, and demographics influencing its mortgage stress levels.

For instance, an LGA with a high unemployment rate might experience increased mortgage stress levels in the future. This level of detail can enable property investors to make informed decisions. It helps in identifying potential risks and opportunities, understanding local market conditions, and devising effective investment strategies. Tools like Microburbs can help explore these specifics.

To deepen our understanding of mortgage stress and its implications on property investments, let’s take a look at three critical indicators provided by Microburbs. These metrics can empower investors and buyers agents with nuanced perspectives on mortgage stress at a granular level.

- Mortgage as a Percent of Income: This metric represents the portion of a household’s pre-tax income used for mortgage repayments. It provides a snapshot of the potential affordability issues within a specific suburb.

- Mortgage Non-Stress (LGA): This metric indicates the percentage of households within a Local Government Area (LGA) spending less than 30% of their pre-tax income on mortgage repayments. A higher percentage of non-stressed households can suggest a more stable real estate market, potentially making it a safer investment area.

- Mortgage Stress (LGA): Conversely, this metric shows the percentage of households in an LGA spending more than 30% of their pre-tax income on mortgage repayments. Areas with high mortgage stress could be facing economic challenges or over-inflated property values. This could potentially create investment opportunities for savvy buyers or pose additional risks.

Annual Income Needed to Avoid Mortgage Stress in Capital Cities

Average income earners in Australia are unable to afford a house in a capital city without plunging into immediate mortgage stress. This table illustrates the annual household income needed to comfortably afford a house in various Australian capital cities. It’s calculated based on the most recent Smart Median Sale Prices and the standard variable interest rate.

| Smart Median Sale Price | Deposit (20%) | Monthly Repayments (6.44% Var. Rate) | Annual Household Income needed to avoid Mortgage Stress (Pre-tax) | |

| Sydney | $1,940,000 | $388,000 | $9,749 | $680,133 |

| Melbourne | $1,460,000 | $292,000 | $7,337 | $498,667 |

| Brisbane | $1,040,000 | $208,000 | $5,227 | $339,920 |

| Perth | $782,000 | $156,400 | $3,930 | $242,340 |

What Suburbs in Each State Experience the Greatest Mortgage Stress?

Mortgage stress varies across states and suburbs in Australia. Here are a few examples:

- In New South Wales, Western Sydney suburbs like Villawood, Yennora and Granville have high levels of mortgage stress.

- In Victoria, the outer suburbs of Melbourne, including Ravenhall and Woodstock, are significantly impacted.

- In Queensland, Caboolture and its surrounding suburbs have reported higher mortgage stress levels.

Mortgage stress is a critical factor affecting the Australian real estate market. Understanding its impacts and how to mitigate its risks can provide investors and agents with a competitive edge. Always remember, thorough research and careful planning are keys to successful property investment in these complex market conditions.

“To be honest with you…”

“To be honest with you…”

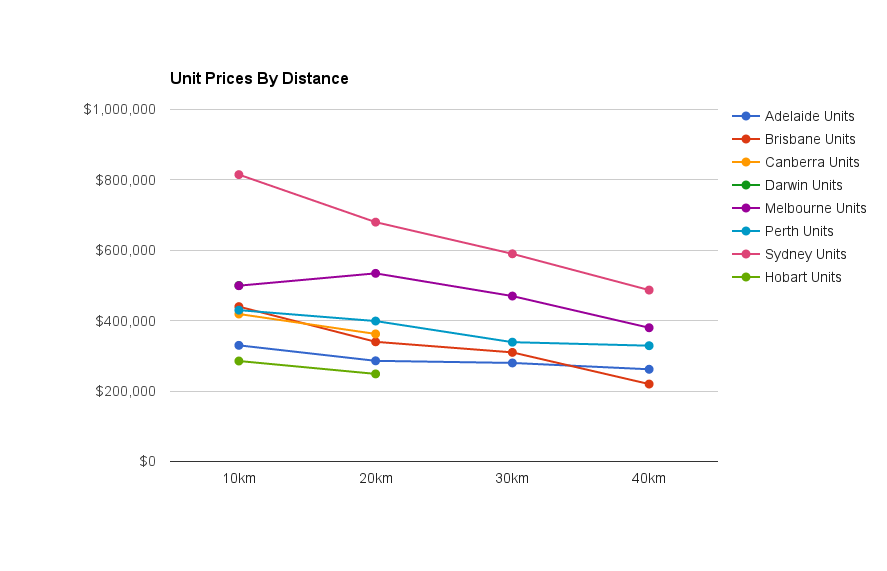

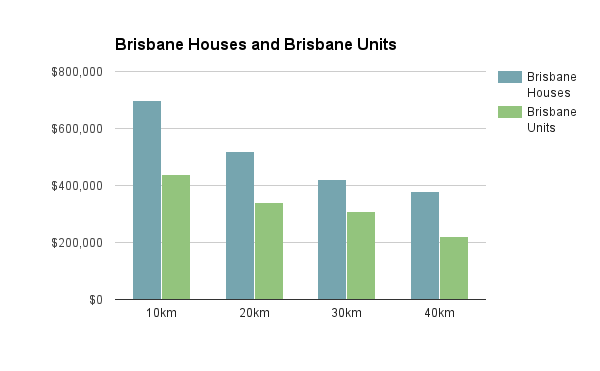

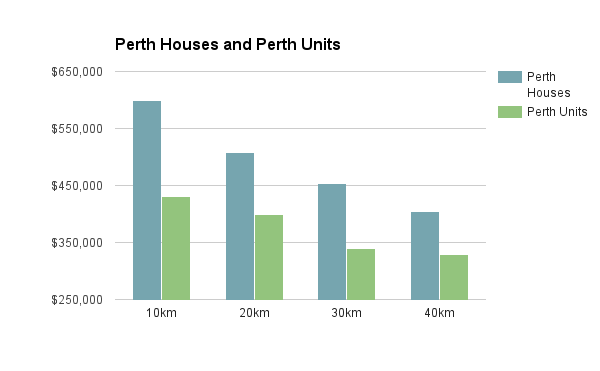

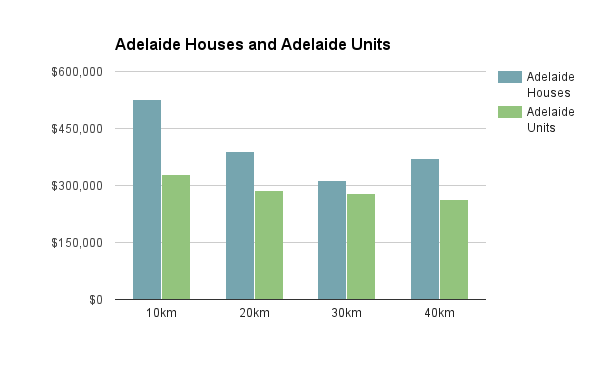

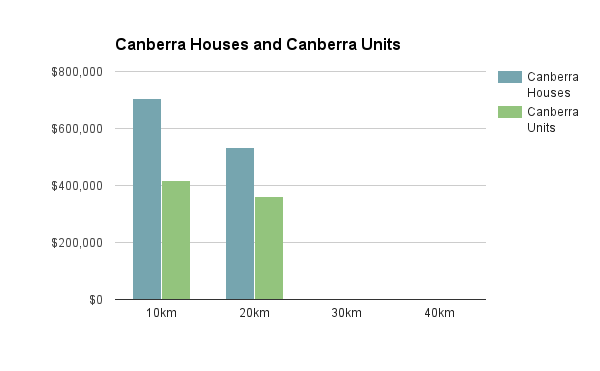

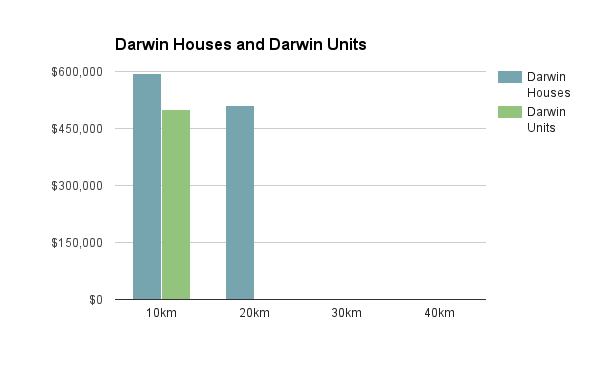

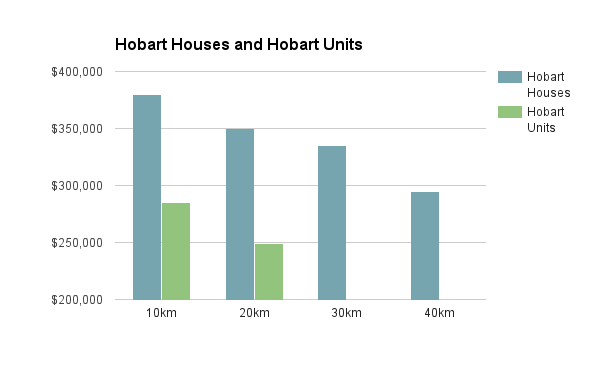

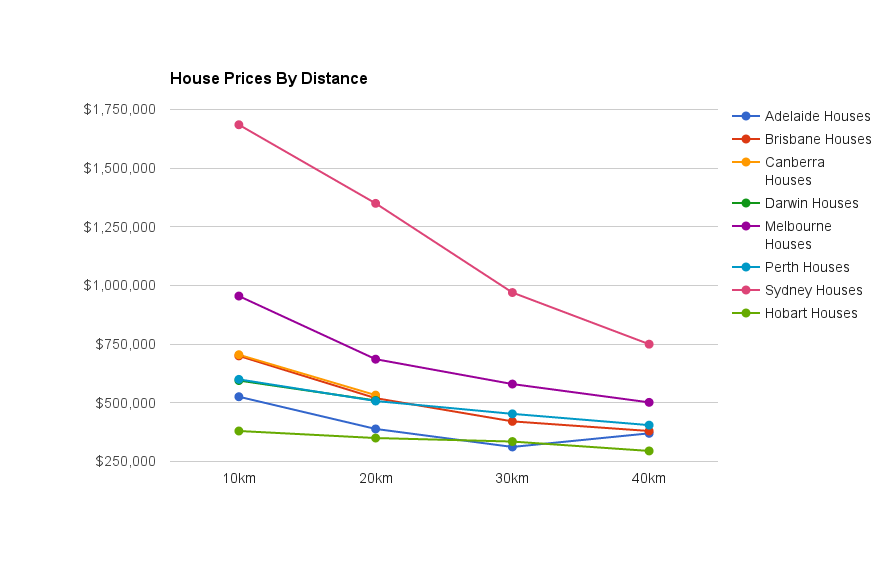

First we’ll look at house prices for all state capitals, grouped by whether they are 0-10km from the centre of the city, 10km-20km and so on. For instance, we can see that if we had a $600,000 budget, we could look at central Perth or Adelaide, 10-20km from the centre of Brisbane or Canberra, 20-30km from the heart of Melbourne and more than 40km from the middle of Sydney.

First we’ll look at house prices for all state capitals, grouped by whether they are 0-10km from the centre of the city, 10km-20km and so on. For instance, we can see that if we had a $600,000 budget, we could look at central Perth or Adelaide, 10-20km from the centre of Brisbane or Canberra, 20-30km from the heart of Melbourne and more than 40km from the middle of Sydney.