In a highly anticipated move, the Reserve Bank of Australia (RBA) decided to maintain the cash rate at 4.10% during its August meeting. This decision comes after a series of aggressive rate increases, with the cash rate having risen by 400 basis points since May 2022, marking the most intense tightening cycle in modern history aimed at curbing inflationary pressures.

Economists had been divided on whether the RBA would continue its rate hike spree or take a pause. During July, over half of the economists surveyed (20 out of 36) predicted a 25 basis point increase in the official cash rate to 4.35%—a level not seen in nearly 12 years. As the announcement drew nearer, speculation was rife among major banks, with the Commonwealth Bank of Australia (CBA) and Westpac expecting a 25 basis point hike, while ANZ and NAB predicted a pause.

While the decision to hold the cash rate steady at 4.10% has come as a relief to some, it’s crucial to note that the central bank may not be done with rate adjustments. While the CBA expects the cash rate to peak at 4.35% before gradually easing to 3.10% by November 2024, Westpac and NAB both foresee a higher peak—4.60%—before a subsequent decline. Westpac estimates the peak to occur by September 2023, followed by a drop to 3.35% by May 2025, while NAB predicts a similar peak in September 2023, but with a lower drop to 3.10% by November 2024.

ANZ, which had initially forecasted a rate rise in July, remains cautious about abandoning its prediction of a 4.6% peak. The bank’s head of Australian economics, Adam Boyton, commented on the uncertainties following the RBA’s decision to pause, signalling that “the journey to the 4.6% level may not be straightforward”.

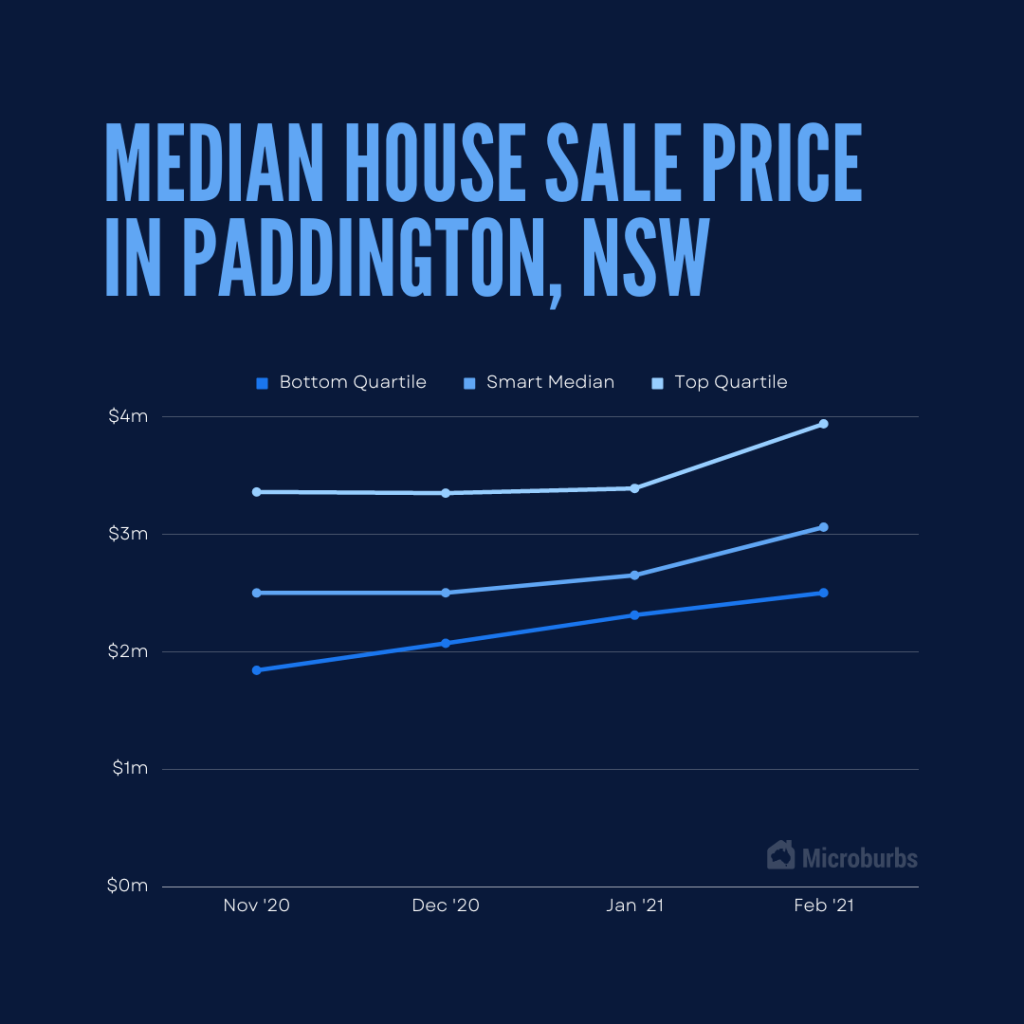

For the real estate market, these interest rate fluctuations can have significant implications. Homebuyers will need to keep a close eye on the market dynamics, as changes in interest rates can impact housing affordability and demand. As rates climb, borrowing costs can rise, potentially affecting property prices and the overall market sentiment. This pause in rate hikes might offer a temporary respite to buyers, allowing them some time to assess their options before the next potential increase.

The RBA’s decision has brought some relief to homeowners and borrowers. However, the future remains uncertain, as economists and major banks have differing opinions on where interest rates will peak.

Having accurate, up-to-date data is essential to navigate the ever-changing real estate market effectively. For the most current and comprehensive information about your suburb, explore Microburbs and get your free report today.