Navigating the Australian real estate market can be a daunting task, but understanding key metrics like the land-to-asset ratio can guide your path to successful property investment. This post will provide insights into the importance of the land-to-asset ratio, how it’s calculated, and how it can impact your potential return on investment.

What is the land-to-asset ratio?

The land-to-asset ratio is a real estate valuation measure that compares the value of the land on which a property stands to the total value of the property – including the land, buildings, and any improvements. This ratio is particularly useful to property investors and agents as it helps determine the intrinsic value a piece of land holds in a property, thereby influencing its potential for appreciation and impact on returns.

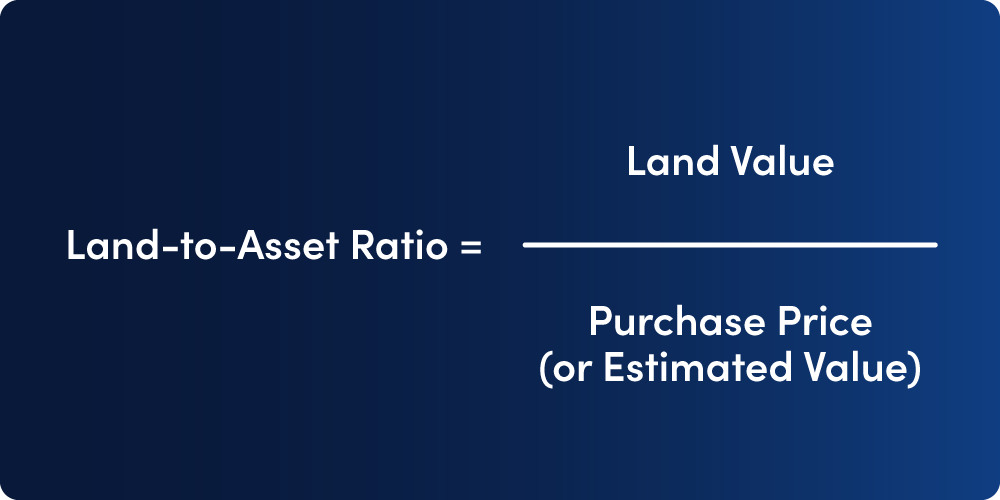

How is the land-to-asset ratio calculated?

The formula for calculating the land-to-asset ratio is very straightforward:

Land-to-Asset Ratio = (Value of Land / Total Value of Property) x 100%

Consider two properties, both valued at $500,000, but with different land values:

| Property A | Property B | |

| Land Value | $300,000 | $200,000 |

| Purchase Price (or Estimated Value) | $500,000 | $500,000 |

| Land-to-Asset Ratio | 60% | 40% |

Property A, with a higher land value, has a higher land-to-asset ratio. This higher ratio can potentially offer better capital growth prospects due to the inherent value of the land. However, as we will discuss further, the ideal ratio is influenced by various factors.

What is the ideal land-to-asset ratio?

While there’s no universal ‘magic number’, from an investment perspective, try to aim for an asset where the land represents at least 70% of the property’s value. In a pinch, don’t settle for anything below 50%. But remember, real estate isn’t a game of absolutes – the ‘perfect’ ratio depends on your unique financial goals, risk appetite, and market dynamics.

How does land-to-asset ratio impact the potential return on investment?

Land tends to appreciate over time, often at a faster pace than the value of the building or improvements. Therefore, a property with a higher land-to-asset ratio can potentially offer higher capital growth, leading to increased returns on investment. Furthermore, the potential for redevelopment or subdivision can also add to the investment’s value.

What are the drawbacks of properties with high land-to-asset ratios?

While properties with high land-to-asset ratios can offer more significant capital growth potential, they are not without their drawbacks. Firstly, such properties may have higher upfront costs, requiring a larger initial investment.

Additionally, because the value is tied more to the land, improvements or renovations to the property may not contribute significantly to its overall value. This might limit the profitability of value-adding strategies.

Compared to properties teeming with improvements, a high land-to-asset ratio property might also fetch you less rental income, potentially dampening your cash flow.

How does the land-to-asset ratio impact the maintenance costs and depreciation of a property?

Properties with lower land-to-asset ratios often mean that a larger portion of the property’s value is tied to the building or improvements, which depreciate over time. These properties also come with higher maintenance costs.

On the other hand, land, which contributes to a higher land-to-asset ratio, requires little to no maintenance, reducing the overall running costs.

How does the land-to-asset ratio vary across different property types and suburbs?

The land-to-asset ratio can significantly vary across different property types and suburbs. Detached houses often sport higher ratios than apartments or units, where you’re paying more for the building than the land. Similarly, the land-to-asset ratio can swing wildly from one suburb to another, juggling factors like proximity to the city centre, local amenities, and demand-supply dynamics. Luckily, tools like Microburbs can help you decode these local market dynamics.

Why Are Median and Quartile Land-to-Asset Ratios for a Suburb Relevant?

The median land-to-asset ratio for a suburb gives you a snapshot of the ‘average’ property landscape, acting as a key guide to inform your investment strategy.

The 25% and 75% land-to-asset ratio quartiles add another layer to the story. They provide a more nuanced view of the property distribution, providing a framework for potential bargains and premium properties. A wide spread between these quartiles indicates greater variability in property types and potential investment strategies. A lower 25% quartile might indicate more affordable investment opportunities, while the 75% quartile can reflect properties with high land value – potential goldmines for capital growth.

In the end, understanding the land-to-asset ratio is like unlocking a secret level in the game of Australian real estate. Sure, it’s not the be-all and end-all, but combined with other factors such as location, market conditions, and your personal financial goals, it can be a game-changer.

Speak Your Mind