We love Australia’s multi-ethnicity, tolerance and openness to other cultures – it’s the nation’s greatest strength. So alarm bells go off when we see headlines and stories like this in the mainstream Herald Sun newspaper.

It’s not racist to point out these home truths

At some Melbourne and Sydney schools, Australian-born children are outnumbered 10 to one by newly arrived Chinese students. Sometimes there are only a handful of other non-Chinese-speaking kids in each class. Signs in local shops are in both Chinese and English, suggesting that many new residents can’t speak our language.” Susie O’Brien, Herald Sun June 10, 2015

Well, actually, we think it is racist to single out Chinese migrants without acknowledging the broader foreign investment issues, the challenges facing regulators in that regard and the fact that Australia is a multi-ethnic country that both encourages and needs migration.

Here are our top five reasons.

1. It puts a ‘Chinese face’ on a complex economic problem

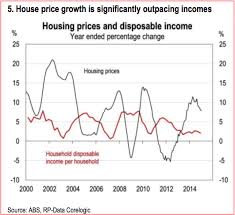

The property bubble is due to a massive upsurge in foreign property investment from many nationalities due the collapse of the resources sector, the falling Australian dollar, and low interest rates necessary to prop up an economy on the cusp of recession. Globally, wealthy people are switching capital from resources into property.

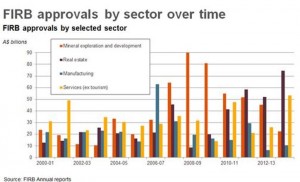

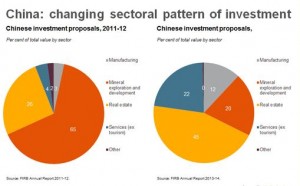

In Australia, Chinese nationals accounted for 16% of the $74 Billion foreign property investment approved by the government in 2013-14 (the most recent FIRB figures available). Chinese nationals invested big money but so did people from many other countries.

The central problem is the scale and suddenness of the current inflows from all foreign sources, combined with a low interest rate environment, which is enabling Australian investors to try to keep up. This ‘perfect storm’ is driving property inflation not Chinese investors.

2. The not in my (elite) back yard factor

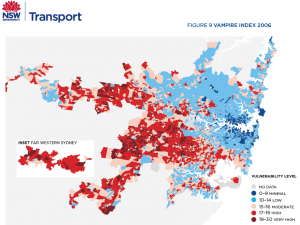

Chinese investors in residential property are highly selective. They are dominating the market in elite suburbs, mainly in Sydney and Melbourne. And this, we suspect, is what is driving the angst: the influx of Chinese money is disrupting the status quo.

3. Australia is a multicultural nation and should know better

Australia always has had suburbs dominated by particular ethnic groups. ABS data shows suburbs that are predominantly Anglo saxon, Greek, Italian, Indian, Vietnamese, Lebanese and so on. No one gets alarmed when migrant groups ‘’take over’’ outer suburbs or help gentrify down market suburbs. The difference is that the Chinese can afford Australia’s best and wealthiest suburbs and are snapping up properties at the top end of the market

4. What’s so bad about people speaking Chinese?

There is nothing unusual about migrants to Australia not being able to speak English well, or about businesses and schools catering to people who don’t speak English.

Many Australians find it confronting to deal with languages other than English but this is an outdated attitude. Rather that complaining about Chinese speaking students in our schools, let’s start teaching Mandarin in public schools and welcome opportunities for our children to become bilingual in English and Mandarin. It might come in handy.

5. It disrespects the value to the economy provided by Chinese investors

Australia has always benefited from foreign investment in property and Chinese capital is helping to create new housing stock and jobs. On one hand the government is courting foreign investment – our economy needs it – on the other, little is being done to make Chinese investors and migrants feel welcome.

The property bubble and the suddenness and scale of foreign investment in residential property is a serious and complex issue. Let’s not distract from constructive debate by making it about race.

For more analysis and detail regarding foreign investment, see Chinese nationals aren’t the only foreigners splurging on Australian property