Over the past 12 months there has been much debate regarding the impact of Chinese investment on residential real estate.

In one corner we have Simon Henry, CEO of Juwai, the Shanghai -based Chinese property portal, arguing that Chinese investment is propping up our economy and warning against tighter rules; “At a point when foreign investment is needed, extra restrictions are being put in place”. He says that negative publicity singling out China is widely reported in the press there. “We see a lot of politicians in Australia saying that they are looking to review and stop Chinese investment specifically, as opposed to foreign investment. “It seems to be a dual message being given, that ‘Yes, we want your investment, but we are going to criticise you if you do invest’.”

In the other corner commentators, including Clive Hamilton of the Australia Institute, warn that cash pouring in from China is making housing unaffordable for ordinary Australians: In a controversial article last year he said “Every weekend in Sydney, young Australian couples are turning up at auctions excited at the prospect of finally owning their own home, only to find that other bidders are wealthy foreign buyers with money to burn”.

Since then the majority of media on the issue has focused on Chinese investment, neglecting to note that Australia is a very attractive destination for foreign property capital in a shaky global economy.

But are Chinese buyers really that dominant in the market? We took a look at the Foreign Investment Review Board (FIRB) data – this only covers approvals for investment but is still one of the best data sources available.

FIRB approvals for Chinese national investment 16% of total

The most recent FIRB report (2013-14) shows that buyers from many nations are investing in Australian property, with billions pouring in from around the world.

Total foreign investment in property 2013-14 was $75 Billion, $35 Billion of which was for residential property. Chinese property investment was 16 percent of the total, at $12 billion and double the next largest nation (USA at $6 Billion). Singaporeans invested $4 Billion, Canadians $3 Billion, and Malaysians $2 Billion. Unfortunately, the FIRB does not publish the break down of residential property investment by nationality. A Credit Suisse Report, however, has estimated Chinese residential property investment over the period at $9 Billion.

Capital has switched from resources to property – this is a global trend as wealthy people seek safe havens for capital

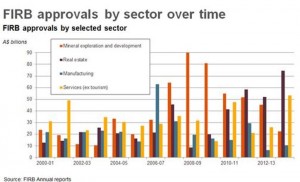

It’s sobering to compare the ratios of investment across sectors of the economy and the dramatic switch to real estate. A few years ago most foreign investment was going into mining. Post the collapse of resource markets, money is pouring into property as a safe haven for capital. The figure below shows that at the height of the resource boom in 2008-09, property investment was less than $10 Billion compared to $90 Billion for mining. In 2013-14 mining was down to $20 Billion, compared to $75 Billion for property. If nothing else, this shows why our leaders are conflicted about how to handle the situation.

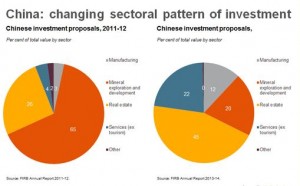

The switch of Chinese capital from mining to property shows the same pattern.

In future years, analysts predict that the Chinese share of total foreign investment in property is likely to grow. Credit Suisse projects a further $60 billion over the next six years.

Australia needs new housing stock but it also needs citizens to be able to afford to live close to major work centers – in this context, Chinese national investment in Sydney and Melbourne may lead to structural problems

In Sydney and Melbourne, Chinese demand now accounts for more than 30% of total new supply. In some preferred suburbs, it is overwhelming.

Sydney Real estate Agent, Amy Baxter, says in some inner city locations Chinese demand accounts for more than 95% of new stock. “Buyers acting for Chinese investors are queuing up for releases; I can’t see any sign of a slow down”. She says some apartments will be left empty by absentee owners. “Many of the buyers don’t care about rental income – they don’t need the money and they don’t want any hassle from tenants”.

A perfect storm for property inflation – low interest rates plus massive foreign capital inflows

Notwithstanding the economic stimulus, it’s government’s role to consider broader impacts on society. The main problem for the government and the Reserve Bank is that ordinary Australian’s are trying to keep up with foreign buyers. The low interest rates necessary to simulate an economy on the cusp of recession are enabling people to take on unsustainable levels of debt.

When the fear of missing out trumps the fear of crippling mortgage payments, statements by the Treasury secretary, John Fraser, that Sydney and parts of Melbourne are in “unequivocally in a property bubble”, or by the head of the Reserve Bank, Glenn Stevens that Sydney house prices are “crazy” only add to the general anxiety.

What to do? If you are an investor with borrowing capacity, punting on further gains on the back of foreign demand is tempting. If you already own your home, you could settle back and enjoy the capital gain – as our PM, Tony Abbott famously said, “I’m happy the value of my home is going up”. If you are trying to buy your first home, or to rent close to work in our major cities, its tough and likely to get tougher.

Sooner rather than later, the government must address this. Concern about property inflation and housing affordability is flushing out the usual arguments around negative gearing, lending rules, super policy and other policy applying to domestic investors. Let’s hope the noise generated does not distract policymakers from dealing constructively with the issue.

A few things seem clear:

- The central issue is better regulation of foreign property investment, so let’s stop making it about nationalities.

- Foreign investment is creating jobs and funding new housing stock – policy makers need to find away to make that stock affordable to citizens

- Australia has always benefited from foreign investment in property – the problem is the scale and suddenness of the current inflows, combined with a low interest rate environment. This ‘perfect storm’ is driving property inflation.

- Chinese investment is dominant only in some suburbs. Australia has many suburbs dominated by particular ethnic groups.

- Australia has always benefited from capital brought in by migrants and from the cultural and intellectual diversity they contribute to society – whatever is done to regulate foreign investment in housing let’s not make it a barrier to migration.

We eagerly await the FIRB’s report for 2014-15.

Speak Your Mind